Newly-wed couples have a lot of things to discuss and coordinate. The highs from the wedding are beginning to ebb, and now comes the reality of your situation.

Marriage entails doing a lot of hard work on the relationship. It’s not just about making sure you keep the spark of love alive, it’s also about establishing great communication. And this includes making sure that you’ve discussed and agreed on your finances.

One of the most significant factors that ensure your marriage is going to work out is keeping an open line of communication and have an agreed-upon battle plan when it comes to your finances.

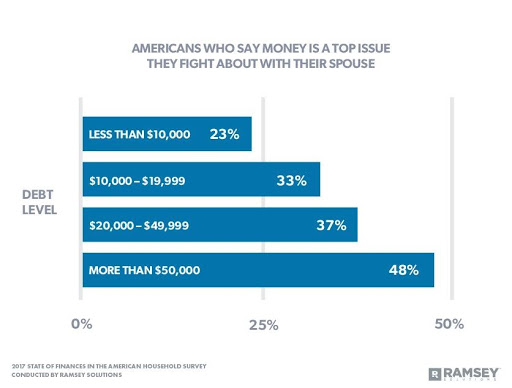

New couples are often surprised to find out that money matters are a major cause of friction in a marriage. So it’s a good idea to iron this out as soon as possible between you and your spouse. Below are a breakdown of common money problems new couples face and ways to manage them.

Prepare before making decisions

Before you sit down and draw out your financial plan as a newlywed couple, you first need to discuss what your priorities are as well as the values you want to adhere to in your plan.

Do you plan to have kids? When do you plan to have kids? Are you big on travel? Do you want to pay off debt? Do you love to shop? These are just some of the things you need to discuss as a couple.

There will surely be some disagreements as to your views on finance and ideas for your future. But this is a good time to hash it out. Agree on things, compromise if needed. This is how married people do it, so get used to this new dynamic.

As part of this discussion, you should also lay all of your cards on the table. Discuss what each one of you is bringing to the table finance-wise. List each of your assets and liabilities. Be thorough when doing this so you can craft a really good financial plan that takes into account these factors.

The money decisions you need to make

You now have an agreed-upon plan and a clear picture of your financial situation. Armed with a general roadmap of where you want to bring your finances as a couple, it’s now time to make decisions.

Below are some decision points and actions you need to take.

Update your estate

One of the first things you need to do is to assess your estate and update information as soon as possible.

You need to determine the information on things like your retirement account, your investments, your life insurance, even your checking and savings accounts. Update each account so that the primary beneficiary is now your significant other.

You should also decide if you plan to establish separate bank accounts or if you prefer to set up a joint account. Other couples blend the two by establishing separate accounts for their savings but putting up a joint account that is used for bill payments and household expenses.

With regards to paying bills, you should also decide on whose name the bills should be put under, as well as who will be responsible for paying the bills. Will it be one person or will it be divided between the two of you? This needs to be clear for both parties as it can be a thorny issue if things are not laid out early on in your marriage.

You also need to update your will and be clear as two who will be the recipient of your assets in case of death. Do remember though that your primary beneficiaries will have priority over what is stated in your will or your trust.

You also need to create a legal document on who will be making decisions on your behalf in case of incapacity. This has financial ramifications so you and your spouse should decide on this, too.

Decide on health insurance details

Your health insurance also needs to be updated when you get married. You can take advantage of your new status to open up new options on your health insurance policy. For example, you and your spouse can decide on whether to:

- A) Add your spouse to your health insurance policy

- B) Add yourself to your spouse’s policy

- C) Keep both policies separately

There will be cost factors to consider here so you need to weigh each one and see which will be the best option to take.

Revisit your employee benefits

You should contact your company’s human resources department and find out if there are employee benefits that can be extended to your spouse. For example, there are company’s that add the spouse to the employee’s health insurance or HMO.

You should also look at your 401(k) and the other retirement plans. Think of it as one single investment portfolio. Look at each of your plans and determine which one has a better investment offering and has lower fees. You should decide if you want to just invest more of your finances into the better plan.

Car insurance savings you can enjoy

Do you know that if you update your marital status, you could probably get a better rate with your car insurance company? There’s a chance that your rate may decrease if you declare that you’re married.

Additionally, you can also get a significant discount if you combine your car insurance and that of your spouse’s under a single policy.

Do you need life insurance?

Some finance experts say that if you are both gainfully employed then you may not need life insurance since your incomes could assume any bills. But you may need to get life insurance coverage if you are both dependent on your salary or income to pay for expenses like your mortgage.

If you have children, then the decision is easier to make. You need to get life insurance. Just remember to make sure the beneficiary list is kept up to date.

Decide on your investment strategy

Even as a newly married couple, you need to start your investment plans.

Determine your combined income and your total expenses. The net of that is the money you can save and, of course, a portion of that can be put on a sound investment plan.

Make sure that you always put away a portion of your money for your savings and your investments. It doesn’t have to be a large sum. Even small amounts that you save monthly do add up to something significant in the future.

Most financial planners suggest that you should allocate 10 to 20 percent of your income to savings and investments.

A good way to start your investment journey is to begin your contributions to your 401(k). They suggest that you should provide for the maximum payments each year if you can afford it. The reason that this is not just a great way to save your money, but it also protects your money from any tax impositions.

If you’re up to it, you can even hire a finance expert who can guide you through making sound investments and help you in shopping around for good finance instruments that will help you grow your money.

For younger couples, you should consider a Roth IRA. Finance experts say this is a sounder option compared to a traditional account. The Roth contributions you make increase without the government putting a tax on it. This is a huge advantage for a young married couple because the compounding value is potentially bigger with that tax break.

Establishing a habit of savings and investing is going to benefit you both in the long term. Your security and your future will depend on these early decisions.

Decide on your debt servicing

If you’re a newly married couple and you are entering your new life with no debt, then congratulations. That’s one less headache to worry about. But for most people, debt is a part of life. For example, credit card debts, student loans, and your mortgage are financial liabilities you need to address as much as possible.

As a couple, you should decide on the best way to chip away at these debts.

You should determine how much of your income you should allocate to paying off these debts. You should also decide which debts should be prioritized over others.

Making sound and wise financial decisions as a married couple is a great step towards ensuring that you are starting your new life together by taking the right steps. Following the tips and advice given above can help you in making these important decisions.