A while back, University of Chicago professor Harold Pollack had an online video chat with personal finance author Helaine Olen. Their discussion was about how regular people get manipulated into buying bad investments by financial gurus.

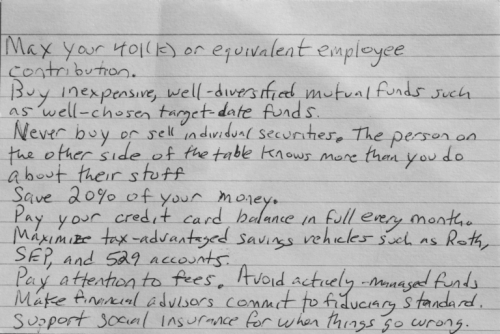

During the conversation, Pollack stated that the best financial advice “can fit on a 3-by-5 index card, and is available for free in the library”. If you’re paying a guru for advice by definition, the advice is probably bad mostly because the good advice advice is so straightforward. Olson challenged him to write down the advice, so Pollack did. And…it went viral.

Here’s what he wrote below:

- You should max out your 401K or at least check out the contribution that your organization makes and put in that amount.

- Purchase cheaper well-diversifed mutual and target date funds for the long term.

- Buying and selling individual stocks or securities is not the best idea. The person on the other side of the investment knows more than you do.

- Save 20% of your money for emergencies, large purchases and job losses. At some point you could face a situation where you will be glad you saved.

- Every month your credit card bill should be paid down to zero. This enables you to control the credit and not let the credit control you.

- 529 accounts are great for kids, Roths are good way to save on your taxes now and n the future when you use the funds. SEPs are great for business owners who would like to contribute to the retirement of their employees or simply a contribution for themselves.

- Fees can really add up when using a fund manager. Keep your eyes on these costs.

- Your Financial Advisor should always be working for you, not ensuring he’s getting richer by making bad investments that hurt you in the end.

- Getting hurt at work, have a child with mental disabilities are examples of things going wrong. When they do you’ll need Social Insurance, so please support it.

How much of this information have you heard from your financial advisor? How much of it is different than what you’ve been told? This little card could be just enough to take your finances into your own hands. If you have a great advisor though, congratulations and happy investing and saving.

Read More

Robert Kiyoaski’s Rich Dad Poor Dad. Kiyosaki’s books shows the differences between his two fathers and how the way each of them dealt with finance made him realize the type of financial person he wanted to be and it can also help you decide the type of financially successful person you want to be.

The Motley Fool Guide to Investing for Beginners by Tom and David Gardner is the perfect read for those just starting out in the investment world the news is practical and easy to use. You can also get even more tips from their newsletter.

The Automatic Millionaire by David Bach is another great book for beginning investors. Especially those that have never heard of things like dollar cost averaging or automatic investing. His advice can make you a millionaire.

Did the information on the 3×5 card help you with your finances? If so, we’d like to hear about it in the comments below.

1 comment

Thanks for sharing this article.

Having a poor credit (or) declined of loan because of any reason? Instant credit loans US providing No credit check loans for personal use on a quick basis.