Let’s talk about something we haven’t talked about in a while…how about the budget? 😛

In April, we made a big change to our budget. Rather than stressing myself out about paying off our card in full every month—I took the entire balance and transferred it to a 0% interest rate card.

I know, I know—that’s not exactly what you’re supposed to do, and how does that ensure that you won’t just rack up more debt on your card??

Well, transferring to a 0% rate may not be the best thing for everyone, but it was the best thing for us. With Eric entering the fire academy and not working for four months starting in late August, I feel much safer and stable having a big cushion of savings to fall back on than worrying about being credit card debt free.

We are still making payments to this card, we don’t have to worry about interest accumulating, and it will be paid off hopefully by Christmas.

As for worrying about accumulating more debt onto our credit card, Eric and I no longer carry around a credit card! And starting this month, I have pre-paid the automatic charges that go on our card anyway, such as cell phone and internet. We hope this will ensure us from not using our spare credit card.

We’ve come up with a pretty simple rule—if we don’t have the cash, we don’t buy it. Crazy, huh??? And guess what? It’s been working!

That did mean that for a couple of days our fridge was pretty bare, but we managed! And as soon as we got paid, we stocked up on food and froze meat that was on sale!

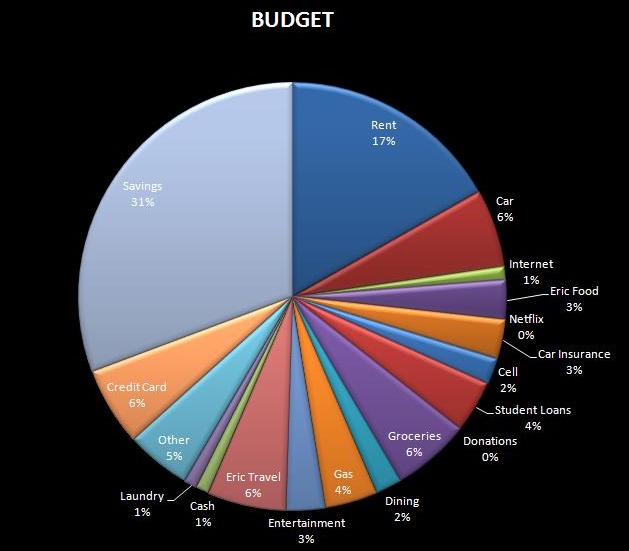

April was such a great budget month for us, I’m hoping May will continue the trend. Here is our budget breakdown for the month:

Some notables:

- We saved 31% of our total income, this included a nice tax refund.

- We cancelled Netflix. (do you ever feel like you have to watch every movie you get as fast as possible or else you’re wasting money if you keep it for more than a couple of days? It was too stressful. Yes, I just called Netflix stressful)

- Had our lowest “Other” month EVER! Only 5% of our budget went to “other,” as opposed to other budgets when it ranged from 11% to 27% of our total!

- We are at 83% of our $8,000 savings goal! And with three months left to go, I have a feeling we’re going to hit it out of the ballpark!

Man, it feels good to be a gangsta!

How are you doing budget-wise?

11 comments

your website is so real and personal…i love this…good for you to sticking to the budget and meeting your financial goals…wooo hooo!

Way to go! You guys are doing so awesome with your budget – I am both jealous and envious at the same time! :0]

Like your Netflix stress, I feel pressure to read library books in time! We watch so few movies that we do Redbox, which surprisingly works out to only 3x/year (sports take precedence in my house. le sigh.). If Netflix is $11/mo, and Redbox/Blockbuster kiosk is $1.05/ea, you’d have to watch more than 10 movies a month to even miss Netflix. Teen Mom marathons can fill that void instead!!! (no judging – I watch it way too much)

And dude, you do what makes you feel comfortable. Transferring to the card makes sense here, and you’re not doing it as a way of burying your head in the sand, which is where the “bad” comes in.

Good for you! 0% interest credit cards work well for us too. I’ve done that before and got a card paid off in under a year. I love doing that!! We used our tax return to pay off small credit card bills (a Best Buy card, a Capital One the Mr. had) and now we are down to 3 major “debts”: 2 credit cards and the Mr’s student loans. We are on track to have 1 card paid off by the end of this year! Good job on your savings goal! That is what we’ll tackle once one of our cards is paid off!!

Wow, congrats on doing so well this month! You are such a good budgeter. I have major, major budget envy. Per usual, my budget is in shambles and I refuse to think about it because it stresses me out. Typical.

I don’t see how 0% could NOT be a good idea, when compared to any%.

Sigh… I’m doing good financially though after vacation I don’t have much for “extra” cash. I think I’ve gotten so used to having extra money these past few months that it’s really hard to not have it. Ya I know… bitch, bitch, bitch… I ONLY got to go on vacation. Geesh.

P.S. Netflix is new in Canada, but I tried it when I was babysitting for my BFF and nearly EVERYTHING I searched for was “unavailable”. I have a PVR and I search all the movie channels and record them all for later. There are actually a lot of really great movies on in the middle of the night if you look for them- lol.

Yay for being so close to your savings goal. I totally dig all of your pie charts and organization. It makes my non-math brain explode, but I wish I could be that organized with our budget.

I recently switched up my Netflix account to receive 1 DVD instead of 3. That way we don’t feel as pressured to watch the DVDs immediately, and we still have access to all the instant content, which we watch ALL the time.

There have been times when I’ve even put my membership on hold for several months when money was really tight. I don’t think I could ever full cancel my membership, though :-p

wow, nicely done!! That’s awesome. I think the 0% card is a good idea. Not like you’er not going to keep paying towards it, ya know? I think that’s great that you are almost to your savings goal too. amazing, really. I can get back to saving with my next paycheck – woohoo – my stupid tax bill did me in, but hey, at least I paid it without savings, right?? little rocks! 🙂

I’m thinking of cancelling my Netflix too. I have NO time to watch it and the movies that come in the mail literally will sit around for weeks at a time before I finally watch them. I’m trying to watch the Must Sees on my list and then I’ll be cancelling it probably by next month.

Awesome budgeting skills!