One thing I’ve realized when it comes to saving money is that you have to put it into your budget. You can’t just say “well, I’ll see what we have left over at the end of the money and then put any extra money into our savings account.”

It simply doesn’t work that way. If there is money in the checking account, it will get spent. $5 here, $5 there…we should buy that because it’s on sale…and 10 “good deals” later you realize you just don’t have anything left.

Which is why a percentage of my paycheck is automatically placed into our savings account. It’s been incredibly hard not to touch it but we’ve managed to triple our savings since January. We definitely haven’t mastered the art of budgeting—as is evident by always seeming to be one paycheck behind…(I’m hoping on a tax return to bail us out). But here are some things that have helped us put more money in our savings account, and less into the black abyss called “spending.”

Downsize

Eric and I were living in a decent one-bedroom apartment in ritzy Newport Beach. In the end, we decided to move down the street—literally two blocks— into a loft and also into a new (and less brand-name) city address. Say what you want, but it’s a lot different to say “I live in Newport Beach” than to say “I live in (insert new city).”

But we’re now saving about $300 to $400 a month. Over a year, that’s a minimum of $3600 saved.

And eventually we’ll have a nicer place, but in the meantime, the loft is a good size for us and our pup (The people who lived here before us had a baby! No clue how they did it…)

Savings: $3600/year

Get a Family Plan

We should have done this earlier, but because he had AT&T and the Iphone, and I had Verizon and a 15% discount through my work, neither of us was willing to switch. We were averaging about $180 a month on cell phones. Eric made the switch to Verizon, got the Droid (which I think he likes better than the Iphone), and we are now looking at a bill around $110 a month, possibly even less with my discount. And did I mention we get free mobile-to-mobile minutes?

Savings: $840/year

Nix the Paper Towels

I know people will make fun of me, but paper towels are expensive. And I also feel that paper towels are like one of the two things you can’t buy generic (toilet paper is the other one!) because I used to have roommates who would buy generic, and I’m sorry, but there IS a difference between generic and Bounty.

Anyway, we were going through about a roll a week, no joke. And every time you stocked up it was about $9.

By cutting up some of Eric’s old t-shirts that he never wears, I’ve managed to create rags that I now use for cleaning the house—saving tons of paper towels. I also keep the paper towels under the sink, instead of displayed on the counter. By hiding them, Eric and I now are more inclined to use a rag before wasting precious (and expensive) paper towels. In the past two months, we haven’t even used an entire roll.

Savings: $80/year

Go out for Breakfast rather than Dinner

Eric and I don’t go out to eat very often, but when we do we usually go out for brunch. We are big on breakfast and not so big on dinner. A good brunch will cost us about $25-30 for both of us. A dinner can easily run us $50. Weekends are the best when you start off with a good brunch.

Savings: $600/year

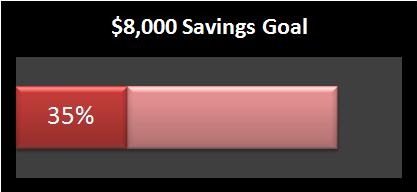

TOTAL SAVINGS? $5,120!

That’s in addition to the $7,400 we saved in this last post for a grand total of $12,520 in annual savings so far! Which is why it looks like we’re on track to hit our $8 to $10 thousand dollar goal by August…

12 comments

Can we please hang out? So your budget awesomeness will rub off a little more on the hubs and I? Maybe your weight loss stuff can rub off on me too. Thanks 🙂

He switched from an iPhone? Isn’t that some sort of sacrilege or something?

I like how you break out your savings by year, that’s a good way to see how it’s worth your time. These are all great (and easy) ways to save too, so it’s definitely sustainable…although, I’m not so sure about the iPhone :0)

Saw this article today and thought of you!

http://finance.yahoo.com/banking-budgeting/article/112202/25-ways-to-waste-your-money?mod=bb-budgeting

Those are some really great tips! You are such a saver 😉

I agree with you saving for the future starts now and adjusting one’s lifestyle will pay off in the end. While some people may make fun of frugal changes, you are definitely making the smart move! Congrats on getting better at budgeting.

Yay for paper towel-less! We haven’t kept paper towels in the house in 5 years, and rarely miss them. Maybe once a year I say “Huh, wish I had a paper towel right now.”

That’s awesome!! You go girl!

We recently just switched off our family plan to save money! It was about $25/month cheaper to be on separate plans because the discount counts towards both accounts! I was surprised too!

I so do all of those things!

We live in a tiny, tiny apartment with our dog.. all in the name of saving money!

Plus going papertowel-less saves the environment too.

Wow, what great tips, as usual. I totally agree on the auto savings thing…otherwise I WILL spend it too! And the paper towels…I hear you on that. I go through one a week, but my sister is WAY worse. She goes through at least 3-4 per week. She’s nuts.

Did I just hear that someone has DROID LOVE!??!?!?!?!!

I love that! Even though my Droid 1 is getting a bit outdated (and Verizon now has the iPhone), the one saving grace has been mobile to mobile…my wife has Verizon, my family has Verizon, and with all the leftover minutes, Ashley can talk to her hearts content to her family on T-Mobile.

And I totally agree on generic toilet paper – truer words have never been spoken. That is not something that is to be taken lightly.

One of my little money-saving tidbit (other than the out-of-sight-out-of-mind putting a set percentage aside and not thinking about it per month) has been to take advantage of off peak-hour restaurant specials (if we go out to eat). I know the local Chili’s out here in Michigan will give you free chips/salsa + non-alcoholic drinks after 10:00 PM, so if we go see a movie or want to eat really late, that’s the best way to get the best deal possible.

You’re doing so well…it’ll be so worth it in the end!