There are several websites out there that can give you complex-looking equations, color coded schemes and in-depth Excel spreadsheets.

My blog is not one of those websites. I hate math—I took Computer Science 101 in college to fulfill my math requirement.

I introduce to you the easy way to make a budget. It happens to be MY way.

Step 1. Calculate your Take-Home Income

You need to work off what you’re actually bringing home, that means after taxes, 401K, health insurance, your flex spending account and anything else that’s deducted from your paycheck.

Step 2. Set up automatic savings deductions

I promise you, that if you automatically deduct savings from your paycheck each month, you will save more money than if you waited until the end of the month to put whatever is “left over” into a savings account.

Some companies let you split your automatic deposit into two accounts—see if your company allows that, and if so, take advantage of it. If not, set up a savings account, that automatically deducts on the day of or day after you get paid. ING Direct is an excellent online savings account, which offers higher interest than most brick and mortar banks.

Out of sight, out of mind. If you don’t see that money in your checking account, you’ll be less tempted to spend it.

How much you should put away in savings is up to you. If you really think you can’t save ANYTHING, start with $10 a month. And gradually increase. We’re saving big for a variety of reasons but even when we were paying off credit cards, we were still socking away about 10% into our savings account (and it came in handy when we had to pay off our credit cards a lot sooner than we thought)…

Step 3. Calculate all non-variable bills and expenses.

This is only your monthly MANDATORY expenses, like rent, utilities, student loans. These are the items you pay every month, without fail, and they are usually the same cost every month.

This DOES NOT include money for groceries, dining out, gas, etc, since these are variable amounts that can change month-to-month.

Step 4. Calculate all your irregular bills.

This includes car registration, and car insurance—you know, those pesky items that you get a bill once or twice a year. Once you’ve calculated this total, divide it by 12, and add it to your monthly non-variable expenses that you calculated in Step 3.

Every month, you will contribute this amount into a separate savings account so that when you do get hit with those bills, you won’t be having to eat Ramen for a week to pay for them.

Step 5. Figure out the Leftover

Here is what your budget should look like at this point:  Now you have what I call “the leftover.” From this leftover amount, you should calculate how much you spend on food, gas, dining out, clothes, etc. (I also refer to it as the OTHER category.) At the end, you should be at 0. Meaning every penny should be accounted for. When you have money floating around, that’s when money seems to magically disappear from your wallet.

Now you have what I call “the leftover.” From this leftover amount, you should calculate how much you spend on food, gas, dining out, clothes, etc. (I also refer to it as the OTHER category.) At the end, you should be at 0. Meaning every penny should be accounted for. When you have money floating around, that’s when money seems to magically disappear from your wallet.

The Leftover is where you can really cut back on expenses. Depending on the month, our food budget varies by $100. Some months we eat more meat, other times we eat more pasta. We really try to stick to these budgets. Gas is another one—now that I have a shorter commute, our gas consumption has gone down.

Entertainment, Dining Out, Clothing, Home Improvement projects, etc are all areas where money can be drastically reduced.

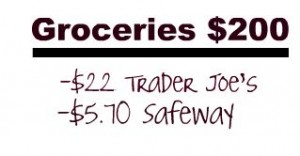

Once you figure out a budget for all these things, you create categories for all of them in your notebook. I usually take two sheets in my budget notebook, and I write on sections of these sheets: Groceries, Dining Out, Clothing, (etc…) and I leave spaces underneath each category.

Then throughout the month, I track EVERY. SINGLE. EXPENSE. And deduct it from the category that it belongs to. I write the date, the amount, and what it was for.

So your grocery budget may look like this:

And so on and so forth.

It can be a pain in the butt, but I usually check our checking account online and add these expenses to the notebook. We also use only one credit card so I can track those expenses too.

Step 6. Cut Back, Pay off Debt and Save

Once you’ve figured out what you have in the Leftover category at the end of every month, this is most likely the amount you’ll be able to squeeze pennies to pay off debt and contribute more to your savings.

Perhaps start by trimming all your leftover budget by 10% across the board. If you have a $100 dining out budget, you’ve just saved $10 and it’s not that much of a difference. You could probably cut that amount from your grocery budget too and not notice a huge difference. Then contribute that money to paying off debt or savings.

There are plenty of ways to save big money by incorporating little changes. Check out how we saved $7,000 by making some small changes!

I hope you enjoyed my guide! And as for how I come up with those cool color-coded pie charts? Honestly, I take each bill and divide it by my total income—that’s how I know what percentage it is. And then I input the info into Excel, using only two columns, and create a pie chart so that I can share with everyone!

10 comments

Great tips! Oh, and I dreaded the math and science requirements at our alma mater! Dreaded!

Very similar to what I do for the most part… except that I have an excel spreadsheet with a tab for every month of the year, and instead of splitting up the cost of my irregular bills by 12, I have a section for “flex money” and I work them into this section for the month I anticipate them coming up.

Also, I include my groceries, gas, transit tickets etc. as part of my mandatory costs- because I gotta eat!

Then I have a section for “fun money” and “extra debt payments”.

I reallly liked the simplicity in this post. I hope people can read it and realize budgeting is really simple and not as scary as it seems. 🙂

OMG this is EXACTLY how i budget! We must be separated at birth!!!! 🙂

You know, I’ve tried to make sense of those complicated spreadsheets and whatnot, and I think you have distilled them perfectly right here. Thanks so much!! I’m so glad I found this blog 🙂

THAT is awesome…I am going to borrow some of these tips for the spreadsheet my sister created!!

You cant see me right now, but i am giving YOU a standing ovation.

Seriously woman… you are amazing. I always ramble about being broke and being a “budget”. My “budget” is more so… “babe, thats too expensive”, “No we cant buy that”, “I haven’t paid the cell phone bill”.But never have i ‘met’ a person so dedicated to their budget and do such a great job at it.

I am going to sit down with my husband and seriously get serious (ha,ha) about our finances. Thanks for being such an inspirations.

We are right in the MIDDLE of doing this. Not fun. Hate math. Thank you for the tips!

Very good strategies that I totally agree with. For me, the biggest hurdle was setting up an automatic savings account. Once I did that, budgeting became much easier.

I also second the irregular bills. I’ve been caught a couple of times not saving up for car insurance, and when that hefty bill comes twice a year, it was a bit of a shock. The great thing about the high interest savings accounts is that while you might not be raking in the dough, you’re still making a little bit of money here and there (not like those accounts used to be).

And as far as cost savings goes, I think our next big step is going to be to cut the cable. We watch more DVDs, Hulu, and Streaming Netflix than we do regular TV. I think when we move to our new place, we’re gonna try it out for 3 months and see how it goes.

I like your plan. It is simple, and involves no math. Win! 🙂